Once you have completed the above steps and found the portal to upload the form, you then need to fill out the form in the two sections of Form 15G. Search for ‘I want to apply for’ and below that select ‘Upload Form 15G’.Then, you need to substantiate the last four digits of the bank account number.Now, select the option ‘ONLINE SERVICES’ - Claim ( Form 31,19,10C).All you have to do is log in to the EPFO UAN (Unified Portal) for the members.Follow these simple steps for a better understanding. You are now aware of the basics of what Form 15G for PF is, and why it is important to fill out this form, now let us have a look at the steps to fill this form for PF withdrawal. Instructions To Fill Form 15G For PF Withdrawal

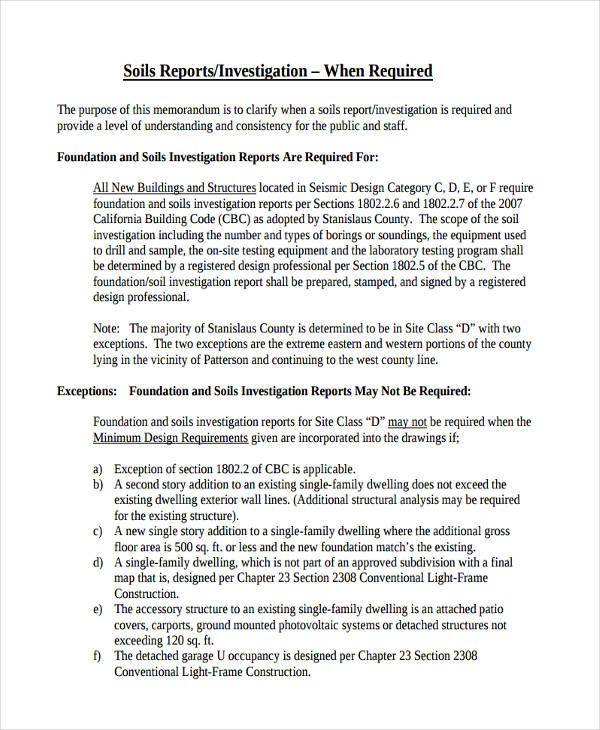

Uses of Form 15G and Form 15H Form 15G and Form 15H to Avoid TDS on Fixed Deposit The difference between these two forms is that Form 15G is made for the people who are less than the age of 60 years and 15H is for the people who are above the age of 60 years. There is another form similar to Form 15G, Form 15H. His employment is also less than 5 years but he is able to submit Form 15G/15H along with his PAN card. If the employee withdraws the money more than or equal to ₹50,000.If the amount of the EPF is less than ₹50,000 but the employee has rendered his service for less than 5 years.If the employee withdraws the whole amount after his 5 years of service.When the service of the employee is terminated due to loss of health, project completion etc.When one transfers his EPF account to some other account.But if the employee is not able to submit the PAN card then the TDS will be charged at 34.6%.The TDS is deducted 10% when the employee submits a PAN card.Before 2016 the maximum limit of this type of TDS was set at an amount bigger than ₹30,000 or more than the withdrawal amount. This limit was raised in the budget of 2016. According to the act, your EPF withdrawal is bound to attract a Tax Deducted on Source (TDS) if you have withdrawn an amount of more than ₹50,000 and have worked for a period of 5 years or less.These EPF withdrawal rules are stated under section 192A, Finance Act of 2015. It is important to know about the TDS in relation to the EPF withdrawal before you start filling out the form 15G for PF. Have a look at the image below to find a sample of Form 15G. An additional facility is provided to you that you can submit the Form 15G on the websites of the major banks in India, online. This form could also be availed from the website of the Department of Income Tax.

FORM 15G IN WORD FORMAT DOWNLOAD

You can easily download it from all the websites of major banks and from the EPFO portal for free. It is very easy to get Form 15G to reduce the burden of TDS deduction.

This was the threshold limit for the years 2021-2022. So, your aggregate interest income should be less than ₹2.5 lakh.

0 kommentar(er)

0 kommentar(er)